The global transportation industry is at a crossroad.

Estimates suggest that in the U.S. alone, commercial trucking companies paid a total of USD 36.48 billion in fuel taxes in 2022. With long hauls in North America slated to grow at a CAGR of 4% (from 2025 to 2030) and the Federal Government’s Executive Order 14057 requiring all vehicles to be zero-emissions by 2035, long haul trucking companies face intense pressure to shift away from their diesel-powered fleets.

Consequently, the focus is on exploring untapped decarbonization options – before the government regulations halt operations.

So, how can the long-haul transportation industry shift toward decarbonized vehicles without compromising on performance, efficiency, and economic viability?

We now have two zero-emission technologies available – Hydrogen fuel cell electric vehicles (FCEVs) and battery electric trucks (BETs). While both are considered as close front-runners with significant transformative potential, a choice between these options is far from straightforward.

What we need to remember is that long-haul operations are not the same as the cars we see on the streets. For long hauls, energy density, range, and turnaround time are non-negotiable.

Let us take a quick look at the comparison between the two for a clearer picture:

Energy Density and Real-World Range

Time is capital for long-haul freight, and that is one of the most compelling advantages of hydrogen fuel cell trucks. Most recent FCEVs come equipped with mature tank systems that deliver real-world ranges of 310-450 miles per fill. These trucks benefit from system-level energy densities of 1.6-2.0 kWh/kg, allowing for higher energy delivery with significantly less weight — an advantage in payload-sensitive sectors.

In comparison, BETs now deliver pack-level densities of 170-210 Wh/kg, with advanced cells reaching up to 325 Wh/kg. Even with larger battery packs, current BETs typically support ranges of 200-300 miles, with only the most ambitious designs targeting 400 miles. While BETs are gradually improving, the FCEVs continue to retain a strong edge in high-utilization, long-haul operations due to their superior energy-to-weight ratio and faster refueling –making them a more practical choice for logistics companies operating on demanding freight routes.

Infrastructure: Momentum versus Maturity

Infrastructure is emerging as the key decider in companies’ long-haul decarbonization efforts, and, in the process, highlighting the clear contrast between hydrogen and battery-electric pathways.

Worldwide, battery-electric recharging infrastructure is making rapid strides. In Europe, for instance, public charging points grew by over 35% in 2024, crossing the one million mark, led by the Netherlands with over 180,000, followed by Germany with 160,000 and France with 155,000. The U.S. is also building on the momentum, with over 130 high-power charging sites (delivering speeds of up to 350 kW) now operating across 25 states. While this supports regional logistics, megawatt-scale charging for heavy trucks introduces significant grid stress, demanding coordinated upgrades to energy infrastructure.

Hydrogen infrastructure, in contrast, remains less mature but is strategically accelerating. In 2024, 125 new hydrogen refueling stations (HRS) opened globally – with 42 in Europe, where regulatory mandates are driving scale. The EU’s AFIR policy requires one HRS every 200 km (~124 miles) on core freight corridors by 2030. During the same period, China has opened 30 stations, South Korea 25, Japan 8, and in the whole of North America, just 13.

So, while battery charging infrastructure currently shows greater volume, Hydrogen offers clearer regulatory direction. Moreover, BET charging networks, though widespread, still face scalability and energy delivery constraints for heavy-duty, high-utilization routes.

Policy Landscape: Uneven but Supportive

Governments worldwide are playing a catalytic role in decarbonizing long-haul transport by backing both hydrogen and battery-electric technologies. However, the balance of incentives varies by region.

In the US, hydrogen is receiving a historic push with USD 170.88 billion in infrastructure expansion. This includes USD 7 billion for regional hydrogen hubs. A federal tax credit of up to USD 3 per kg for low-carbon hydrogen, plus state-level perks like Colorado’s vehicle incentives, make it a viable diesel alternative. BETs benefit from purchase subsidies and infrastructure grants, with California adding extra rebates for fleet electrification.

Canada’s hydrogen roadmap supports large-scale blue and green hydrogen projects in Alberta and Quebec, aided by provincial incentives.

In Europe, BEVs find greater favor, with grants of EUR 2,000-6,000 (USD 2,320–6,960) per heavy vehicle and up to EUR 5,000 (USD 5,800) for commercial fleets through the SEBA subsidy. Germany offers accelerated depreciation for EVs, while hydrogen also receives support in select countries.

Strategic Outlook: Complementing, Not Competing

The notion that one technology will ‘win’ over another is a legacy mindset. Diesel thrived not because it was perfect, but because it was backed by a single, dominant system. The zero-emission transition will be far more complex, which may turn out to be for the better.

It is clear that BETs make perfect sense for urban deliveries, short-haul logistics, and regions with dense charging infrastructure. Hydrogen fuel cell trucks, on the other hand, make sense where range, refueling speed, and operational uptime hold sway – critically seen, the hallmarks of long-haul transportation.

The most progressive fleet operators, therefore, will not choose between hydrogen and batteries. Rather, they will decide where and when to deploy each across the ground realities and aligned to the core strengths. What this would mean is more a more strategic fleet planning paradigm for a zero-emissions future – ensuring flexibility, foresight, and infrastructure-aligned decisions across geographies.

Next Steps: Agile Product Development Framework for Truck OEMs

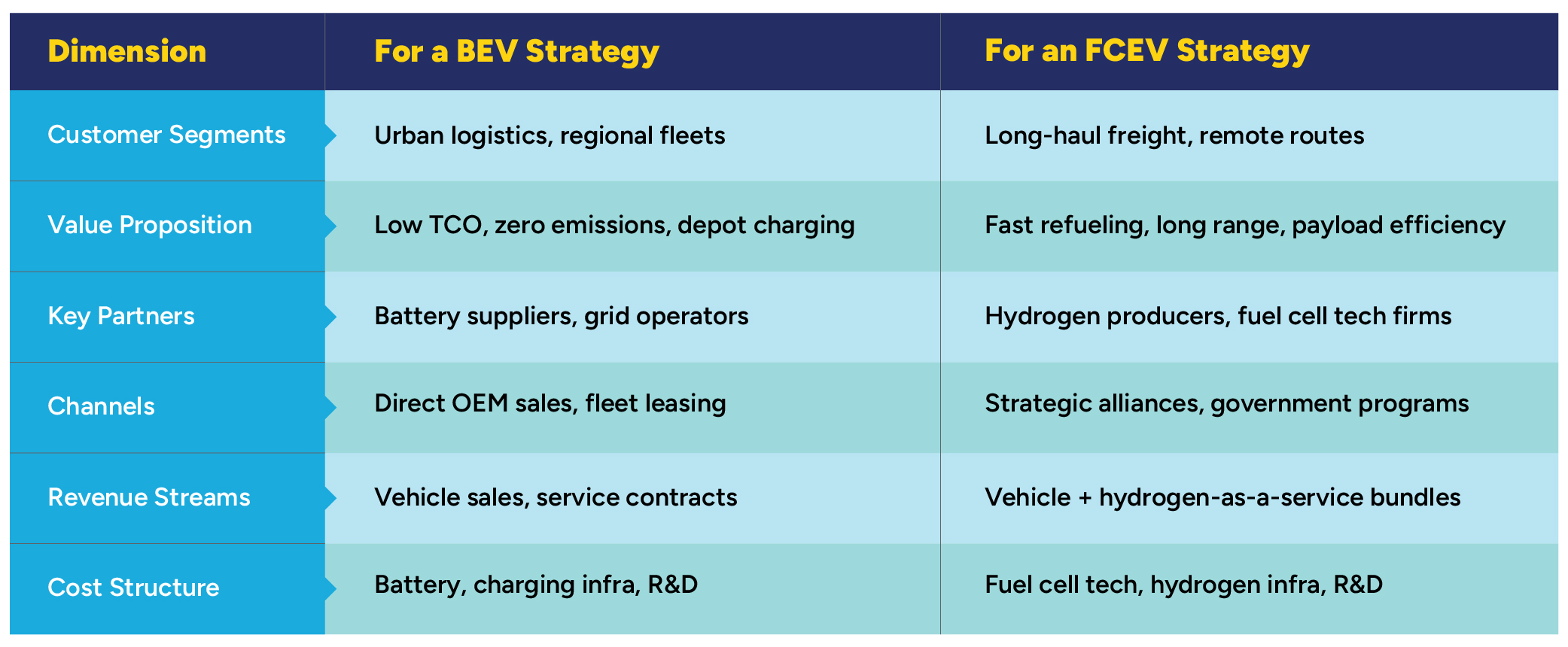

OEMs operating in this emerging ecosystem need to balance their New Product Development roadmap for both BEV and FCEV. This would help them realize timely Return on Investments and enable them to stay ahead of the competition.

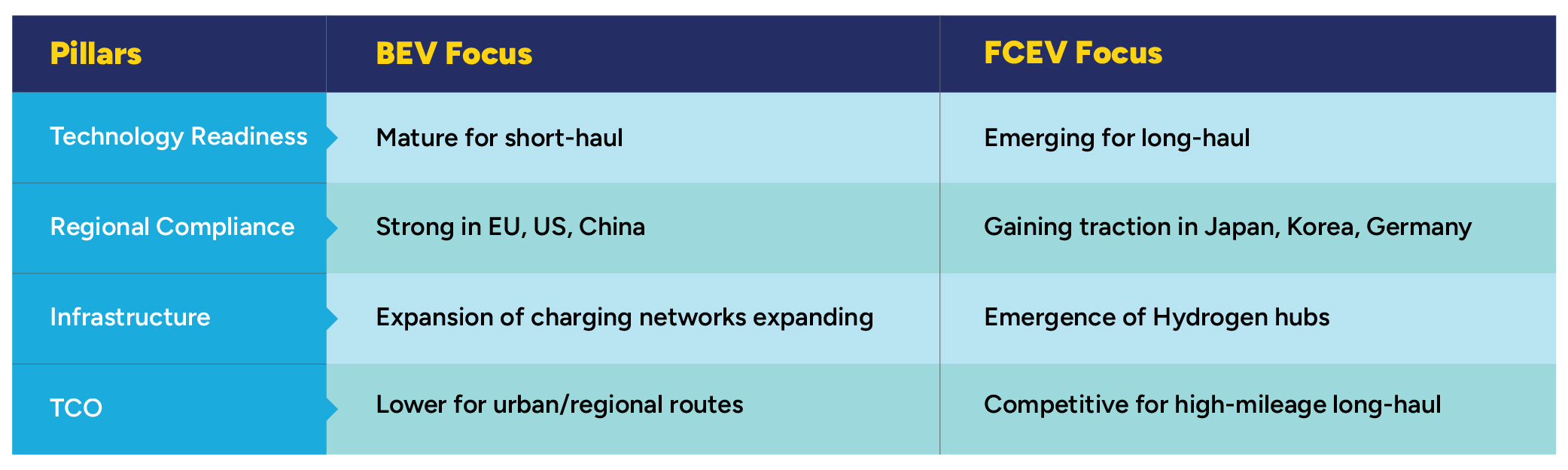

Development Pillars

Agile Product Development Planning

The future belongs to organizations that adopt best practices in BEV and FCEV development—leveraging modular platforms, regional customization, and rapid prototyping. Success will hinge on data-driven insights, agile validation through pilot fleets, and strong partnerships with engineering and technology experts to accelerate innovation and deliver sustainable mobility solutions for tomorrow.